Will Renters Insurance Cover Water Damage?

Updated March 19, 2020 . AmFam Team

Renters insurance can help to cover all sorts of damages and losses to your property. But does it cover water damage and sewer backup? If your apartment is damaged by water, your renters insurance may be able to help you cover the costs of replacing your belongings. It all depends on the type of water damage.

When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event. Sump pump failure and water backup coverage is available as an optional add-on though.

So what kind of water damage does renters insurance cover? We’ve got the info to help you understand just how renters insurance can help.

What Types of Water Damage Does Renters Insurance Cover?

Your renters insurance water damage coverage is meant mainly to protect your personal belongings and the property of others in your apartment, not the actual structure of your unit. Here are a few types of water damage that your renters insurance may cover:

Water Leaks

Many people store toiletries and beauty products in the cabinet under their sink. But if your apartment’s sink springs a leak and damages expensive hair care tools and cosmetics, like that $200 curling wand, your renters insurance may be able to help you recover that financial loss.

Burst Pipes

Let’s say you’re on vacation when your rental home’s furnace stops working, causing your pipes to freeze and burst while you’re away. If this happens, your renters insurance may help cover damage to your personal property.

Damage to Other People’s Belongings

If water damage to your apartment seeps into another unit, damaging the resident’s belongings, your renters insurance liability coverage can help protect your finances from the cost of replacing their things.

What Types of Belongings Are Covered With Renters Insurance for Water Damage?

One of the standard coverages of your renters insurance is personal property protection, which helps protect your personal property from a covered water damage loss. This includes many different kinds of things you own, including:

- Jewelry

- Appliances

- TVs

- Laptops

Does Renters Insurance Cover Sewer Backup?

If sewer backup happens in your apartment, you may be wondering if your renters insurance will cover damage to your personal property. Unless you’ve purchased sewer backup, septic backup and sump overflow coverage in addition to your standard renters policy, your renters insurance won’t cover your personal property should a sewer backup occur.

Paying Your Renters Insurance Deductible

One thing to keep in mind before filing a renters insurance claim is your deductible. If the value of the items you’re trying to recoup isn’t enough to meet your deductible — which is typically between $500 or $1000, depending on your policy — you may want to think twice before filing a renters insurance water damage claim. Not only will your insurance not pay out for anything below the deductible, you may see a premium rate increase for filing a claim.

We know that a deductible isn’t always the easiest thing to pay after an unexpected event American Family Insurance offers Diminishing Deductible coverage as a way to help reduce your deductible amount.

What Types of Water Damage Does Renters Insurance Not Cover?

Not all types of water damage are covered by your renters insurance. In some instances, damage caused by water will be covered by your landlord’s insurance. For example, if your landlord has flood insurance for the building and a flood damages the carpet in your first floor apartment, you wouldn’t have to file a claim with your renters insurance.

In other instances, certain types of water damage need their own coverage or insurance policy or just may not be covered altogether. Make sure you know what’s covered by your renters policy before filing a claim.

Does renters insurance cover floods?

If you live in a floodplain or somewhere prone to flooding, consider purchasing a separate flood policy. You can protect your belongings from flood water damage, and having your own flood insurance policy can make a big difference — because your renters insurance won’t cover your personal property in the event of a flood.

What Types of Water Damage are Covered by a Landlord?

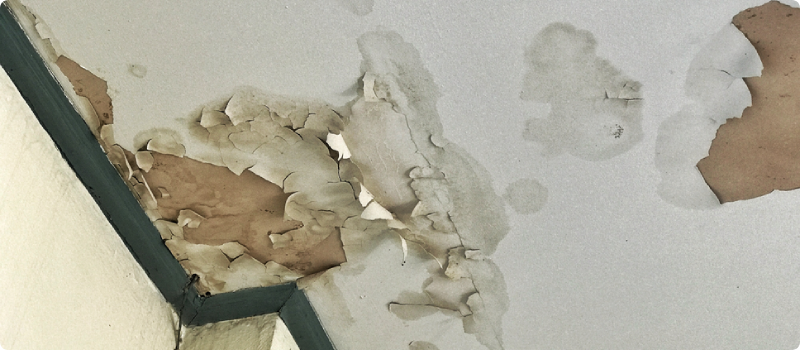

In some instances, water damage may be covered by your landlord instead of covered by your renters insurance policy. Generally, your landlord’s insurance will cover damage to the apartment itself and will not help replace your things if they’re damaged. For example, water damage caused by building maintenance issues that cause stains on your walls or mold growth is typically the responsibility of your landlord, not you. However, a landlord’s policy will vary with different commercial policies that cover different things.

Ensure You’re Covered With Renters Insurance for Water Damage

If your belongings have been recently damaged by water or sewer backup, contact your American Family Insurance agent to see if you should file a renters claim. They can help you navigate the details of your deductible and get all the information together that you need to file a claim.

Have a question about renters insurance? Check out our Renters Insurance FAQs.

This information represents only a brief description of coverages, is not part of your policy, and is not a promise or guarantee of coverage. If there is any conflict between this information and your policy, the provisions of the policy will prevail. Insurance policy terms and conditions may apply. Exclusions may apply to policies, endorsements, or riders. Coverage may vary by state and may be subject to change. Some products are not available in every state. Please read your policy and contact your agent for assistance.