Homeowners insurance terms made simple

Updated March 23, 2017 . AmFam Team

If you find yourself confused by insurance terms, you’re not alone. Insurance jargon can seem complicated — that’s why we’re here to help! Our glossary of homeowners insurance terms will get you up to speed on language that will help you better understand your coverages and how they help you protect what matters most.

To get even more confident in your coverage, take a look at our homeowners insurance checklist — we designed this step-by-step guide to help you understand how the home insurance buying process works. Use our glossary to help you better understand the checklist.

Need to clear up anything else? Your American Family agent is the perfect person to ask.

A

Actual cash value (ACV). An estimate of the fair market value of your property (e.g. home, roof, belongings in your home) was before the loss occurred. Technically, ACV is what it would cost to replace your property minus depreciation, which is how much value the property has lost due to age and wear and tear since you bought it. Learn more about actual cash value.

Additional insured. Refers to a person or party other than the policyholder who is added to the policy so they’ll be covered.

Additional living expense. Coverage that pays for additional living expenses, such as hotel costs and meals, in case you have to temporarily relocate in the event your insured residence becomes uninhabitable due to a covered loss. Also known as loss of use coverage.

Adjuster. A representative of your insurance company who investigates your insurance claim. After investigating the claim, they’ll work with you to determine the amount you’ll be paid.

Agent. A qualified expert that’s licensed to sell insurance on behalf of an insurance company. We believe your American Family agent is your advocate — they’re knowledgeable about your insurance needs and always available and ready to help answer any questions you have regarding your insurance. Our agents are required to take exams administered by the Department of Insurance and many continue their education throughout their careers to always be informed in order to offer expert guidance. We want you to have confidence that your insurance needs are being reviewed by the best in the business.

Application. A form created by an insurer that collects information about the property and person who wants insurance. An insurer relies on this information when deciding whether to issue a policy. You’re required to sign your application to attest to the accuracy of the information.

B

Betterments. See Improvements.

Binder. A temporary agreement declaring that the policy is in effect. A binder is used to prove to your lender that you have homeowners insurance when it’s not possible to issue a policy immediately.

Blanket coverage. An insurance policy that provides coverage for a variety of items with only one limit of insurance. For example, instead of scheduling one building at $10,000, one building at $40,000 and one building at $50,000, a blanket policy would be issued with a $100,000 limit that covers all three buildings.

C

Cancel. To terminate a contract or a policy.

Cancellation. The termination of your home insurance policy during the policy term.

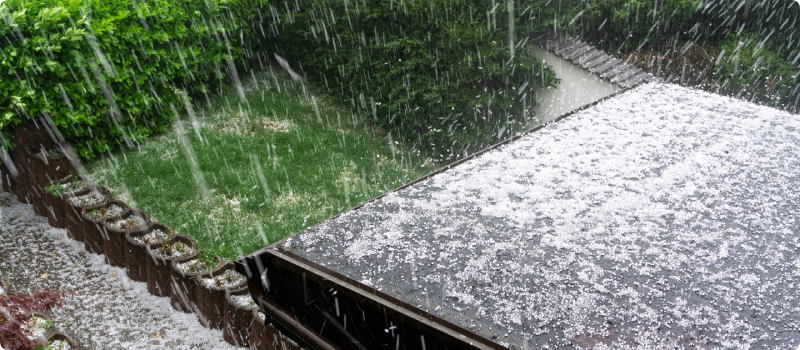

Catastrophe. A disaster affecting a specific geographic area. They can cause injury, death or result in extensive property damage. Hurricanes, floods, tornadoes, and even large hailstorms are typical examples of catastrophes. Learn more about catastrophe claims with American Family.

Claim. An insurance claim is when you make a request to your insurance company to pay you after a loss. If your insurance company validates the claim, you’ll be issued a payment.

Claimant. A third party who makes a claim against you.

Coverage. The protection against financial loss provided by an insurance contract. Having home insurance coverage helps you recover financially in the event of the unexpected.

D

Damage. Physical harm or loss of property.

Damages. The money that one party is legally obligated to pay another party.

Declarations. The page in a policy that shows the name and address of the insurer, the period of time a policy is in force, the amount of the premium and the amount of coverage. Keep reading to better understand your declarations page.

Deductible. The amount of the damage or loss that you’re responsible for before your company pays the balance on a claim.

Depreciation. A decrease in the value of your property (e.g. house, roof, stove, oven, etc.) due to wear and tear or becoming obsolete.

Dwelling. A structure for people to live in.

Dwelling or building coverage. The part of your homeowners insurance policy that helps pay to rebuild or repair the physical structure of your home if it’s damaged due to a covered loss.

E

Effective date. The date that your coverage goes into effect.

Endorsement. An add-on to your insurance policy that changes the coverage provided in your policy. Learn more about endorsements.

Escrow. Money placed in the hands of a third party until specified conditions are met.

Exclusion. Type of loss or a cause of loss that is specifically not covered by your homeowners insurance policy. Your policy will have a section labeled exclusions that will list them.

Expiration date. The date on which your insurance policy expires.

F

Fire resistive. Refers to buildings made of steel and concrete or other nonflammable materials.

Fire wall. A fire resistive wall erected to slow or stop the spread of fire between parts of a building.

Flood insurance. Flood insurance protects against damage done by the rising or overflowing bodies of water. Your homeowners policy doesn’t cover flooding, but you can buy flood insurance coverage separately. American Family offers flood insurance from the National Flood Insurance Program.

Frame. Refers to a variety of frame construction of either wood, metal, or timber (non-brick homes).

G

Garage. Detached or attached structure which you store your vehicles in.

H

Hazard. An action, condition circumstance or situation that makes the occurrence of a loss more likely. Read more to understand hazard insurance for your home.

Homeowners insurance policy. A homeowners insurance policy financially protects your home and your family with a combination of dwelling structure coverage, personal property and personal liability insurance.

Housekeeping. Generally, refers to the overall care, cleanliness and maintenance of a property, and is a key factor when an underwriter considers accepting your policy.

I

Identity theft fraud expense protection. Coverage that protects you from the costs related to restoring your identity. Having identity theft insurance with American Family Insurance means you’ll have someone by your side every step of the recovery process to help make the process simpler, quicker and less expensive.

Improvements. Additions made to a building that increase its value. Fixtures, alterations, additions, installations and repairs are forms of improvements. Also known as betterments.

Inflation protection Adjusts your home insurance policy limits to account for increases in costs to repair or replace your home or property due to inflation.

Insurance. Something people buy to protect themselves from losing money in the event of an accident or unexpected mishap. It’s an agreement between you (the person being insured), and your insurance company, where you’ll pay a certain amount up front — your premium. In the event of an accident, injury or other loss covered in your policy, you’ll pay a small portion of the financial cost, known as the “deductible,” and the insurance company promises to pay the balance.

Insurance contract. The document that is the agreement between your insurance company and you (the policyholder) detailing the terms and conditions of your insurance coverage.

Insured. The policyholder: the person(s) protected in case of a loss or claim.

Insurer. The insurance company that provides insurance coverage and services.

Inventory. A home inventory is a list of your possessions and their value that allows you to more easily and quickly settle claims and report losses on tax forms.

L

Lapse. A policy that ends because you did not pay the premium amount.

Larceny. Theft of personal property.

Lessee. A tenant who has signed a lease.

Lessor. A person who rents his or her property to another under the terms of a lease.

Liability insurance. A part of your homeowners insurance that helps pay for damages owed for bodily injury or property damage that occurs on your property, or that from your activities. For instance, someone slipping on your floor. Here’s some more info on homeowners liability insurance.

Limit of liability. The maximum amount your insurance company has to pay for a claim. Always make sure to refer to your individual policy to understand your policy limits.

Loss. The injury or damage sustained by the insured that the insurance company agrees to cover.

Loss history. The losses you have suffered, and their values, over a certain period of time.

Loss of use A part of your homeowners policy that provides reimbursement for living expenses when loss of or damage to property by a covered peril forces you to maintain temporary residence elsewhere. Also known as additional living expense.

Loss payee. Someone who receives insurance payments in the event of damage to property. The loss payee must have a financial interest in the property. Loss payees include property owners and mortgagees.

M

Manufactured home insurance. Specialized coverage for mobile or manufactured homes.

Market value. What your home would sell for in the current market.

Medical expense coverage. Insurance that pays the cost of medical care to an injured person regardless of who is at fault for the accident.

Mutual insurance company. An insurance company that is owned by its policyholders — not stockholders.

N

Named-peril policy. A policy in which you’re covered only for the specific hazards named in your policy, such as wind, hail, fire, earthquakes, etc.

Negligence. When a person doesn't exercise reasonable care in a given situation, they may be considered to be negligent. One can be negligent as a result of doing something or not doing something.

Non-renewal. A decision by an insurance company not to renew a policy at its expiration date.

O

Open peril. A form of insurance that provides coverage for all losses or damages except those that are specifically excluded in your policy.

Other structure coverage. The part of your homeowners insurance policy that covers the buildings on your property other than your home, such as a detached garage, barns and swimming pools. Find out more about other structures coverage.

Over-insurance. Insurance that exceeds the actual value of the property insured.

P

Perils. The specific risk or cause of a loss covered by your insurance policy. Examples include explosion, collision, flood, fire, theft, vandalism, water damage, etc.

Personal liability insurance. Coverage that financially protects you in the event of an accident, whether at your home or away from it, that results in bodily injury or property damage that you’re legally responsible for.

Personal liability umbrella policy. An extra layer of liability coverage over and above your primary insurance limits. If a loss exhausts your primary liability coverage, a personal liability umbrella policy can provide coverage for the excess damages.

Personal property. Refers to property such as clothes, furniture and other items you own that are not buildings. Learn more about insurance for your personal property.

Physical hazard. Danger of loss arising from the condition, occupancy or use of the property insured. Examples of physical hazards that may increase the probability of loss include unsafe or unclean conditions, cheap or flammable building materials, etc.

Policy. A formal written contract of insurance.

Policy owner. The person or party who owns an individual insurance policy. The policy owner is typically the person who pays the premium and has authority to make changes to a policy.

Premium. The amount of money an insurance company charges to provide coverage.

Property insurance. The insurance of real and personal property against physical loss or damage.

R

Real property or real estate. Land and whatever is erected on or affixed to the land, such as buildings or structures.

Reinstatement. When an insurance company puts a policy back in force after it was lapsed because of nonpayment of renewal premiums.

Renewal. An extension of an existing policy for another policy period.

Renters insurance. Property insurance that provides coverage for someone renting the place where they live. Find out more about how renters insurance works.

Replacement cost value insurance (RCV). Coverage that pays the replacement cost to restore or replace the damaged or destroyed property back to the condition it was in before the damage happened.

Rider. Mostly used in life insurance, a rider is a document that adds additional coverage to your policy.

Risk. The chance that a loss may occur.

S

Scheduled personal property. If you have expensive items, such as jewelry or antiques, your homeowners policy may not be high enough to cover the full cost of replacing them. You can pay an additional premium to have them covered as scheduled personal property.

Sump pump overflow coverage. Provides insurance protection in the event your sump pump system fails and water overflow occurs and causes damage. Learn more about sump pump overflow coverage.

T

Tenant or renter insurance. A form of homeowners insurance sold to persons who rent vs. own their homes. A tenant or renter policy combines personal property and personal liability coverage. It is like a homeowners policy, except that it does not include coverage for the building itself.

Term. The length of time for which a policy is written. For property policies, the policy period or term is typically 12 months.

Third party interest. A party (other than the policyholder and the company) having some interest in the subject matter of the policy, typically as mortgagee or lien holder.

Total loss. When your home is totally destroyed or the cost to repair or rebuild it exceeds the policy limit.

U

Umbrella insurance. Umbrella insurance is additional liability coverage that offers limits over and above your homeowners and auto policies. It may also provide broader coverage than the policies that underlie it.

Underinsurance. When the limits of a property policy are less than would be needed to cover a total loss.

Underwriter. The person who accepts or rejects risks for an insurance company.

Underwriting. The process an insurance company uses to decide whether to accept or reject an application for a policy.

V

Vacant home insurance. Insurance for a home you own that will be vacant for a period of time. Find out more about vacant home insurance.

This glossary represents only a brief description of terms and is for informational purposes only. This article is not part of your policy and is not a promise or guarantee of coverage.